TL;DR:

When it comes to investing, most people don’t fail because they picked the “wrong” product. They fail because of how they behave.

That’s the heart of behavioural investing: the idea that your choices, your discipline, and your ability to stick with a plan matter more than finding the perfect fund. But that doesn’t mean all portfolios are created equal.

Recently, a Life Sherpa member asked us a great question:

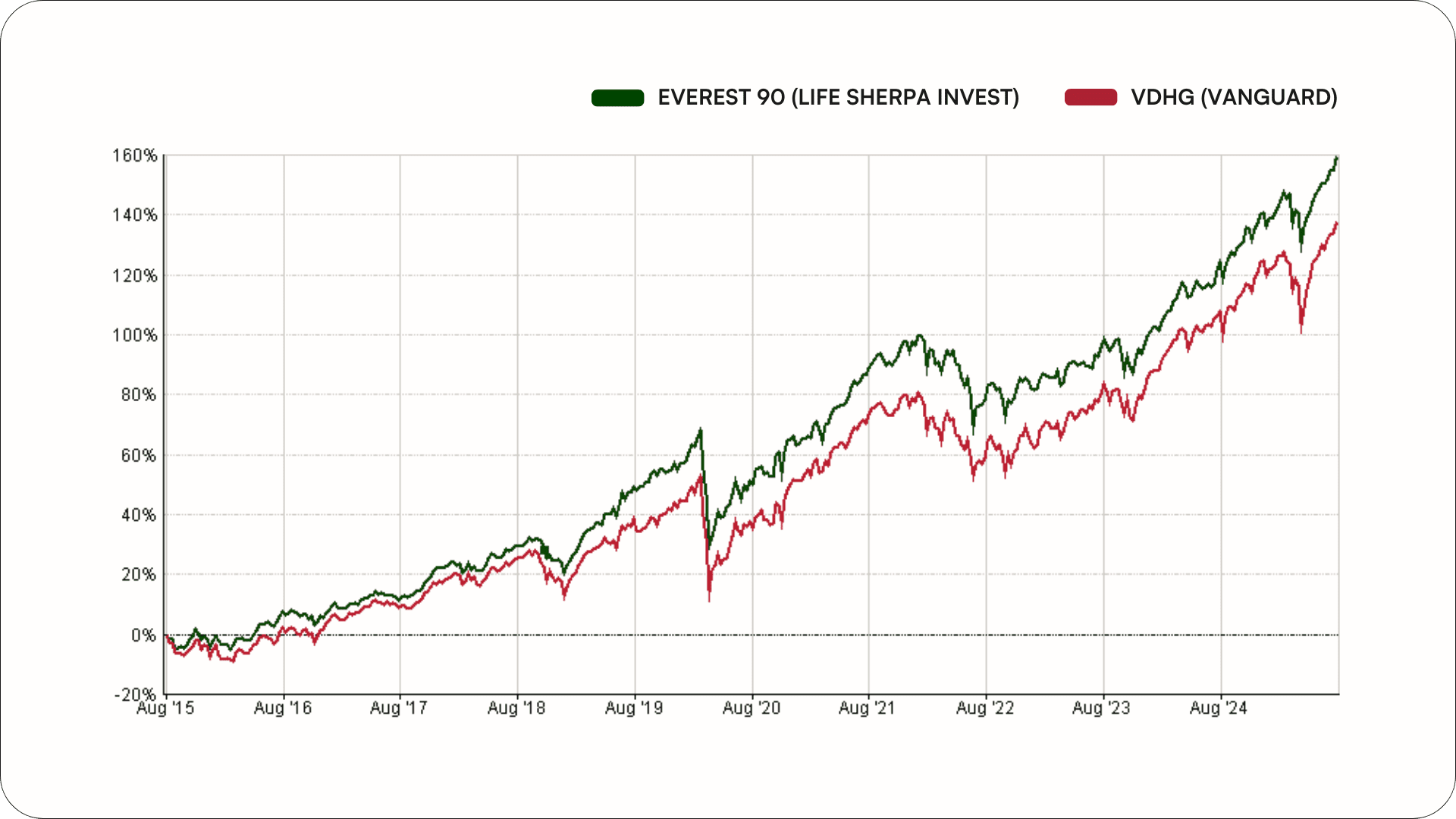

“Why should I choose Life Sherpa Invest's High Growth portfolio (Everest 90) over something like VDHG?”

It’s a smart comparison. VDHG (Vanguard Diversified High Growth) is one of the most popular ETFs around. It’s cheap, simple, and widely recommended online. But as with most things in life, simple isn’t always better.

Here’s why smarter diversification can help you behave better as an investor and why that’s more important than any single product.

Diversification is more than a buzzword

VDHG bundles global shares, Aussie shares, and some bonds. That’s a solid starting point, but it’s not the whole picture.

Everest 90 adds more layers:

-

Real estate

-

Infrastructure

-

Gold

-

Smaller companies (beyond the ASX300)

-

Plus, we don’t hedge foreign currencies back to Australian Dollars the way VDHG does.

Why does this matter? Because real-life investing isn’t about chasing the best return in any given year. It’s about building a portfolio that reduces volatility without sacrificing returns. That mix of extra ingredients helps smooth the ride, making it easier for you to stay invested through the ups and downs.

The numbers tell the story:

Over the past 10 years (to 31 July 2025):

-

Everest 90 delivered 9.53% annually (pre-tax, net of fees including OpenInvest platform fees).

-

VDHG delivered 9.05%.

-

Volatility was lower too: 9.92% vs. 10.67%.

Even better, Everest 90 outperformed in 8 of the 10 calendar years to December 2024.

That consistency matters more than you think. Because it’s consistency — not wild swings — that helps investors behave well.

Let’s be honest: the biggest risk to your portfolio isn’t the market. It’s you.

Behaviour is the real edge

When markets dip, the temptation to panic and sell is strong. When things are booming, it’s easy to over-commit.

This human tendency is why most unadvised investors underperform the funds and the markets in which they invest.

A more diversified portfolio that behaves steadily makes it easier for you to behave steadily. And that’s the whole point of behavioural investing: set yourself up so you can stay the course.

Want to understand diversification better?

If the word “diversification” makes your eyes glaze over, don’t worry — we’ve made it crystal clear in this short video on the basics of investing. It explains asset allocation (fancy words for “how you spread your eggs across many baskets”) in plain English.

Understanding this one concept can change how you think about investing forever and give you more confidence to stick with your plan.

The bonus benefits of Life Sherpa Invest

On our investing platform, you can choose from four professionally managed, evidence‑based portfolios, each tuned to different goals, timelines, and risk tolerance. Across all four portfolios, you get:

-

Broad diversification (shares, property, infrastructure, and more) designed to smooth the ride so you can stick with your plan.

Access to proven return boosters, such as small companies (outside the ASX300) that you won't be able to access directly unless you have an extensive investment portfolio

-

Professional management + performance and tax reporting built in — fewer admin headaches, less time spent on spreadsheet wrestling.

-

A joined‑up approach that puts your portfolio in the context of your life stage, values, and goals.

The bottom line

If you love a one-size-fits-all ETF and don’t mind tracking your own performance and tax, something like VDHG might still suit you. But if you want smarter construction that’s built to keep you calm, diversified, and consistent over time, Life Sherpa Invest has the edge.

Because investing success isn’t about being clever. It’s about setting up a plan you can stick to that works with human behaviour, not against it.

Find the portfolio that fits your climb

Life Sherpa Invest gives you four smart portfolios, built to match your goals, timeline, and risk tolerance.

Explore Life Sherpa Invest

Paolo Sevilla

Content Writer

Paolo Sevilla is a multimedia producer, artist, and content writer for Life Sherpa. With over three years of training under Life Sherpa’s financial advisers, Paolo combines his creative expertise and financial knowledge to craft content that empowers readers to achieve peace, freedom, and abundance with their money. Through engaging storytelling and practical insights, Paolo strives to make financial education accessible and inspiring for all.

Related Articles

Sign up to learn more money management tips!

Trending Articles

Why not take a quick quiz?